In this article, I want to show you how to look at your organization and its environment to conduct this analysis the right way.

Strengths and Weaknesses

Let’s start. Look within your organization. This is like diagnosing your health. You need to know what’s happening. What works well, and what could be improved. It is very important to distinguish between factors which originate in your company and those that come from outside. Now let’s focus on your internal qualities.

- Strengths are all the things about your business which make it better than its competitors. Positive cash flow is a strength. An experienced team is a strength. A set of effective procedures is a strength.

- Weaknesses on the other hand, are things you struggle with. The lack of a marketing strategy is a weakness. A high level of fixed costs is a weakness.

Opportunities and Threats

Now let’s take a look at events that happen on the market. Usually, these are things that you can’t change. You can either come to grips with them or avoid them. For this, you will need to know the organization’s environment.

- Opportunities are all the positive events that may happen outside your company. Socio-political stability would be an opportunity for most of us. Unless you are some kind of weapons dealer. A small number of weak competitors can also be an opportunity. As well as qualities like a growing market or the opening of new regions.

- Threats are events you’re afraid of. Like war. Unless… Anyway, emerging strong competition, frequently changing regulations (unless you’re a lawyer) and other events that can affect your business in a dangerous way land in this category.

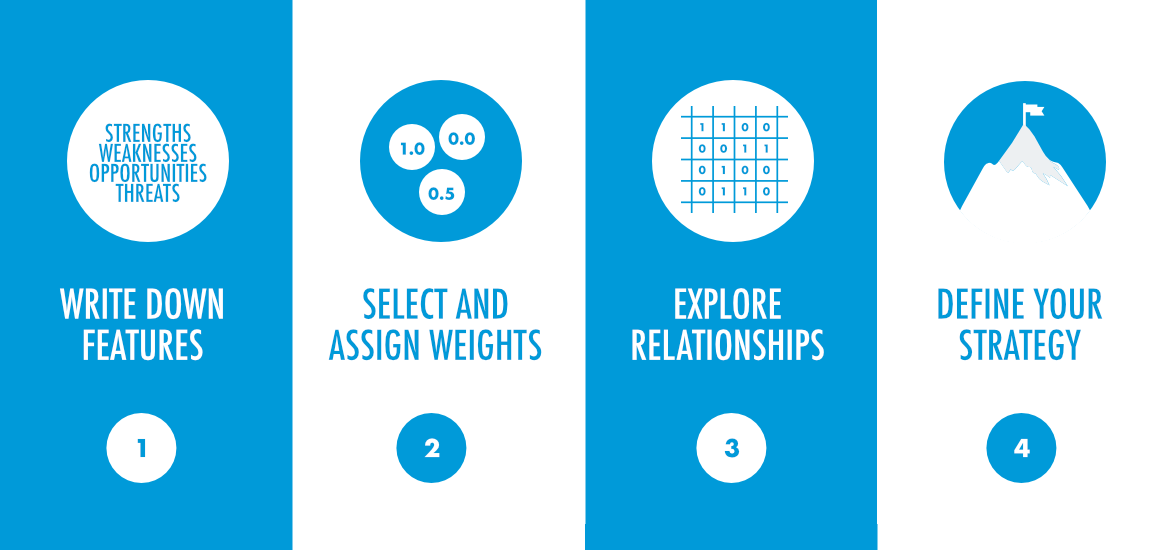

So now, what you need to do is write down all these things. Your company’s strengths and weaknesses as well as the opportunities and threats occurring in the environment. For each category, choose the most important five. At this stage, you need to decide which of these are most plausible and would have the biggest impact on your business.

Weights and interactions

When you’ve chosen five factors for each category, it’s time to weigh them and decide which of them are the heaviest. Weights sum up to 1.0, so if one quality is 0.5, then the other four have 0.5 to share. Check if they interact. You can start from the inside or from the outside. However, the most important thing is to find out how all these factors interact with each other.

- Do your strengths help you take advantage of upcoming opportunities? Or maybe upcoming opportunities give you the ability to use your strengths?

- Do your strengths help you avoid or deal with the threats? Will the threats decrease the impact of your strengths?

- Can your weaknesses stop you from using opportunities? Or maybe these opportunities will help you overcome your weaknesses?

- Can your weaknesses make the threats even more dangerous? Or maybe it’s the other way around and these threats make your weaknesses even more impactful?

Now that you know what the qualities of your business and its environment are, you need to make some calculations. You will need the number of interactions between internal and external factors. Opportunities with strengths and weaknesses and also threats with strengths and weaknesses. Then, multiply the results with corresponding weights. Finally, put the numbers of interactions and the weighed sum into to SWOT Matrix.

The Matrix of strategies

Now, it’s time to choose your optimal strategy. Put the numbers into the matrix. The field with the biggest numbers will be the one for your strategy. The possible strategies are:

- Aggressive (maxi-maxi) is for those who have many strengths and operate in the market among many opportunities. Your main idea will be to use all your strengths to make much of opportunities.

- Diversification (maxi-mini) is

the conservative strategy. Your organization is strong, but the environment isn’t very nice. Like JohnRambo, or James Bond, you need to use all your strengths and work hard to overcome threats. - Turnaround (mini-maxi) is the competitive strategy for those operating in a favorable environment, but who have very few internal strengths, or strengths which do not interact with available opportunities. You should try to work on your weaknesses and gain as much as possible from the opportunities.

- Defensive (mini-mini) – if you land here, I have some bad news for you. You will have to defend yourself. This strategy includes withdrawal, cost reduction

and other unpleasant actions. If you’ve done this analysis before investing any money, and the defensive strategy is your result, then it’s probably time to leave the table.

Summary

You can work on SWOT in different ways. On a basic level, pen and paper is all you need. If you want a more advanced option, and you are already savvy with office tools, you can use a well-designed Excel spreadsheet (or Google Docs, or a similar application). However, if you have less time and prefer a dedicated solution which automates the process described above, CayenneApps may be a great fit for you.

SWOT/TOWS analysis seems like a simple tool, but it requires a lot of accuracy and conscientiousness. It is crucial to seriously evaluate both strengths and weaknesses, and opportunities and threats, and then think deeply about all the relationships which exist between them. I hope this article has given you a few essential bits of information, which in turn will help you to incorporate SWOT/TOWS in your toolbox.